Swiss Bank Merger

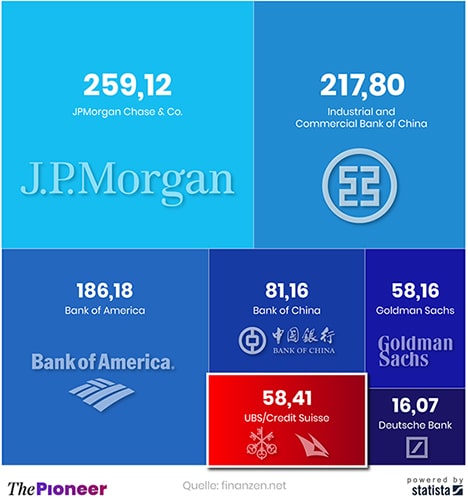

The Swiss banking system has lost its international influence after the great financial crisis. The institutes are struggling with competition from America and Asia. According to the ideas of UBS Chairman of the Board of Directors Axel Weber, that should now change.

According to the Zurich online portal “Inside Paradeplatz” and the Bloomberg news agency, there are talks between the two major Swiss banks UBS and Credit Suisse about a possible merger. The driving force is Axel Weber, the current Chairman of the Board of Directors of UBS and former President of the Deutsche Bundesbank. Last year he had already explored a merger of the fund and asset management of UBS with that of Deutsche Bank. Talks have stalled, which is why Weber is now examining other options for accelerated growth.

With regard to business on the home market, a merger of the two big banks would be extremely problematic in terms of competition law, since the two institutions together have a market share of more than 60 percent, which is also reflected in their combined total assets: this was recently the equivalent of just under 1, 7 trillion euros. That is roughly two and a half times the Swiss gross domestic product.

According to the observers who are active in the financial center of Zurich, Weber’s considerations are less about a total merger than about the merging of foreign businesses. Not a new giant, but a strengthened Swiss banking sector would be the result.

Gabor Steingart