Cryptoassets: Taxation of Individuals

*Note: Due to the current situation in the world when the mobility of the significant part of the world’s population is limited, the main focus of people is on online activities. Due to this cryptoassets are even more popular then they used to be before.

However, cryptocurrencies are not recognised as money and all the transactions with them are taxable. In the article our experts outlined the most important tax issues. But reasonable care shoud be given as the different details of the transaction may affect tax liability.

At LEXeFISCAL LLP, our experts will be glad to assist, answer your questions, compute your tax liability and assist you in solving any problems you may have relating to this topic.

Scope of this note

Cryptoassets and underpinning them distributed ledger technology have attracted significant attention globally. Spread of transactions with cryptoassets caused countries to develop their own strategies in the legal regulation and tax treatment of cryptoassets and dealings with them.

This article provides an overview of cryptoassets and the underlying technology, represents the main activities with cryptoassets focusing on cryptocurrencies, i.e. Bitcoin, Litecoin and equivalents. Despite the absence of their support by central banks or other central bodies cryptocurrencies are commonly used as means of exchange or for investment.

The nature of cryptocurrencies and the types of transactions with them determine their tax treatment. The article considers the position of HMRC that denies the recognition of cryptocurrency as of currency or money and highlights the intangible nature of cryptoassets.

The main focus of the article is on the taxation of transactions carried on by individuals with respect to UK regulation. Particular attention is given to the last guidance of HMRC issued on the 20th of December, 2019 that determines the location of exchange tokens held by individuals for their UK tax purposes.

However there are still many complex issues that are not covered in the article but may significantly affect tax liability. Special care should be given to the calculation of tax payable in order to avoid unnecessary penalties imposed by tax authorities. At LEXeFISCAL LLP, our experts will be glad to assist, answer your questions, compute your tax liability and assist you in solving any problems you may have relating to this topic.

Distributed ledger technology

Distributed ledger technology (DLT) is used to refer to technologies that enable participants to securely propose, validate, and record updates to a database (ledger). ‘Distributed’ means that the database is stored and maintained simultaneously by multiple people and organisations, rather than one central database controlled by one person. The word ‘ledger’ refers to the fact that the database is a record of many individual transactions.

Distributed ledgers can be used in the same way as any conventional database that sets out who owns what, or who did what. They can contain a range of data, such as ownership of existing financial assets (for example, shares), tangible assets (for example, wine, houses), or digital assets (for example, Bitcoin). Distributed ledgers can be publicly or privately distributed, and publicly or privately owned.

The term ‘blockchain’ is often used interchangeably with DLT, but it refers only to its one specific type and not to the whole technology as such. Blockchain derived its name from the manner in which groups of data, or ‘blocks’, are stored and serially linked between each other in a ‘chain’ in the ledger. As a result, from merely looking at the database a participant may understand whether the data is correct, or whether it may have been modified. The integrity of the data offers transparency and develops trust without necessarily having trust in the counterparty.

Blockchain networks can be broadly categorised as either:

- ‘permissioned’ when only approved persons can access the network database, validate and store transactions in it; or

- ‘permissionless’ that allows any person to become one of the multiple participants who can access information stored in the network database.

Bitcoin was the first platform that used DLT in its blockchain form to record information and build a decentralised network where there is no central, trusted authority and which is open to anyone to participate. As a result, Bitcoin is commonly used to facilitate peer-to-peer payments without participation of a central (third) party.

Today, all cryptoassets utilise various forms of DLT (be it blockchain or otherwise), although the use of DLT extends far beyond financial services.

Cryptoassets

Cryptoassets are one application of DLT that are generally issued on permissionless networks. The commonly known cryptoassets are Bitcoin, Litecoin, other cryptocurrencies, and those issued through the Initial Coin Offering (ICO) process, often referred as ‘tokens’. However, the market is rapidly growing and currently around 2500 different cryptoassets exist.

Broadly, a cryptoasset can be defined as a cryptographically secured digital representation of value or contractual rights that uses some type of DLT and can be

- transferred,

- stored or

- traded electronically.

In the Cryptoasset Taskforce report HM Treasury-Financial Conduct Authority-Bank of England identified three broad types of cryptoassets:

- Exchange tokens or ‘cryptocurrencies’ as they are also known such as Bitcoin, Litecoin and equivalents. They utilise a DLT platform and are usually used as means of exchange or for investment. They are not issued or backed by a central bank or other central body and, in contrast to security or utility tokens, do not provide the types of rights or access.

- Security tokens amount to a ‘specified investment’ and may provide rights such as ownership, repayment of a specific sum of money, or entitlement to a share in future profits. They may also represent transferable securities or financial instruments.

- Utility tokens can be redeemed for access to a specific product or service that is typically provided using a DLT platform. As such they are usually used to support capital raising and/or the creation of decentralised networks through Initial Coin Offerings (ICOs).

These categories or cryptoassets are not mutually exclusive and depending on its use a cryptoasset may fall under several categories at any one time or at different points in its lifecycle. For example, in order to raise capital through an ICO a company may issue a new cryptoasset (category 3) that an investor may then buy for investment purposes (category 2). Originally intended as means of exchange (category 1) Bitcoin is currently held by many users for investment purposes (category 2). It is worth mentioning that regulatory frameworks in certain jurisdictions also consider an additional fourth category of hybrid tokens that shares characteristics of multiple categories.

While cryptoassets can be used as means of exchange, they are not considered to be currency or money, as the G20 Finance Ministers and Central Bank Governors set out . HMRC takes the same position and defined cryptoassets as an intangible asset. In the meantime, it highlights that the tax treatment of all types of tokens is dependent on their nature and use and not on their definition.

This paper considers the taxation of exchange tokens (like Bitcoins) and does not specifically deal with utility or security tokens.

The location of exchange tokens

On the 20th of December, 2019 HMRC issued a guidance on the location of exchange tokens held by individuals. This guidance is relevant for taxes calculated on the remittance basis, i.e. Income Tax (IT), Capital Gains Tax (CGT), and for related Inheritance Tax purposes.

HMRC highlights that in order to determine the location of an intangible asset, the courts generally evaluate the nature of the asset and find a suitable comparison. In this regard it states that:

- exchange tokens can be ‘turned to account’, for example, via exchanging them for goods, services, government-issued currency (also known as fiat currency) or other tokens, and as such they have an economic value;

- exchange tokens represent a new type of intangible asset that is different to other types of intangible assets, such as shares or securities;

- the beneficial owner is the only party that is able to be identified and should be considered.

Therefore, HMRC took a position that if an UK resident individual holds exchange tokens as the beneficial owner it is deemed that the exchange tokens are located in the UK and, therefore, income from transactions with tokens is subject to UK tax.

If there are two or more beneficial owners each will be taxed where he is recognised as a tax resident taking into account provisions of double tax treaties. The fact that one or more of the co-owners are UK-based will not affect the place of taxation of other co-owners who are not UK residents.

Generally, a person is considered as a beneficial owner if his or her right to use and enjoy the income is not constrained by a contractual or legal obligation to pass on the payment received to another person, i.e. he or she does not simply act as an agent, nominee or conduit for another person who in fact receives the benefit of the income concerned.

For Inheritance Tax purposes HMRC considers cryptoassets as property and states that in this case common law is relevant but only to the extent that Double Tax Treaties do not determine the required location.

HMRC resumes that taxation at the residence of the beneficial owner most accurately fits the majority of the transactions with cryptoassets and gives a clear, logical, predictable and objective rule which can be easily applied.

Income Tax

General provisions

HMRC considers as highly unusual that an individual can carry on business of a financial trade in cryptoassets. However, as with any activity, the question whether cryptoasset activities amount to a trade is a question of facts and depends on different factors and individual circumstances. HMRC compares a trade in cryptoassets to a trade in shares, securities and other financial products and adheres the approach from the existing case law on trading in them.

Traditionally the approach taken in deciding whether an individual is carrying on a trade in shares and other financial instruments is different from that adopted for companies. The basis for this lies in the comments of Pennycuick J in Lewis Emanuel & Son Ltd v White [1965] 42TC369 where he referred to the word ‘speculation’ and described ‘this class’ of activities of individuals ‘as gambling transactions…’ as opposed to companies that ‘must act within the limitations of its memorandum of association…’.

Pennycuick’s view that, for individuals, share transactions could amount to investment, trading, or speculation falling short of trading, was followed in Salt v Chamberlain [1979] 53TC143. In that case Oliver J stated that ‘it is for the fact-finding tribunal to say whether the circumstances proved in evidence or admitted take the case out of the norm.’

HMRC refers also to the cases Wannell v Rothwell [1996] 68TC719 and Manzur v HMRC [2010] UKFTT 580(TC) where such activities were considered. In these cases, one can find other factors that may be relevant to determine whether an activity that has been taken is ‘out of the norm’. However, they also show that no one factor can be recognised as a determinative and all the relevant circumstances should be considered as a whole.

Reverting back to cryptoassets, to verify whether the activity amounts to a taxable trade (with the cryptoassets as trade receipts) HMRC evaluates degree of activity, organization, risk and commerciality of transactions with cryptoassets carried on by the individual.

If the activities with cryptoassets amount to a trade they will be considered as a business. In this case Income Tax will take priority over CGT and will be chargeable as trading profits. The amount of Income Tax chargeable may be reduced by offsetting any losses from their trade against profits or other income provided that required conditions are met.

Generally, individuals prefer capital treatment as the rate of CGT chargeable on gains is 10% for basic rate taxpayers and 20% for the rest subject to possible reliefs provided the conditions are met. Carried interest gains and residential property gains are recognized as “upper rate gains” taxable at 18% or 28% tax rates. Income tax rates are significantly higher may reach up to 45% although subject to possible tax reliefs provided the conditions are met.

If the activities do not constitute trade, individuals are liable to Income Tax and National Insurance contributions (NICs) on cryptoassets if they receive them in connection with:

- the employment as a form of non-cash payment;

- mining, transaction confirmation or airdrops.

Employment income

HMRC does not regard cryptoassets as currency, money and counts cryptoassets received as employment income as ‘money’s worth’, i.e. a benefit that does not take the form of money or, in other words, benefits in kind. For the purposes of Income Tax some benefits in kind count as earnings within section 62 ITEPA 2003; the rest are dealt with under the benefits code that deem them to be earnings, or that direct that they are taxed as employment income.

Benefits that are money’s worth count as earnings if they represent:

- something that is of direct monetary value to the employee, or

- something that is capable of being converted into money or something of direct monetary value to the employee

For NICs purposes ‘earnings’ is defined in section 3(1) SSCBA 1992 and includes any remuneration or profit derived from employment. In most cases, a payment that counts as earnings for tax purposes is recognised as earnings for NICs purposes. However, in a disputed case, it is important to consider the term separately for Income tax and NICs purposes.

Any further disposal of the cryptoasset received through employment may result in a chargeable gain liable to CGT (see Capital Gains Tax. General provisions).

Mining

Mining typically involves using computers to solve difficult math problems in order to generate new cryptoassets. Cryptoassets can be awarded to ‘miners’ for their verifying additions to the digital ledger.

If the mining activity does not amount to a trade, its pound sterling value (at the time of receipt) is taxable as income (miscellaneous income) with any appropriate expenses reducing the amount chargeable. Any further disposal of cryptoassets may result in a chargeable gain liable to CGT (see Capital Gains Tax. General provisions).

Fees or rewards received in return for mining (for transaction confirmation) are also chargeable to Income Tax, either as trading or miscellaneous income depending on the circumstances. If the individual later disposes of the received cryptoassets it may result in a chargeable gain for CGT purposes (see Capital Gains Tax. General provisions) or, in case of a trade, get taken into account in computing any trading profits provided there is an increase in value from the time of acquisition.

Airdrops

Where someone receives an allocation of tokens or other cryptoassets is known as an airdrop. This might happen as a part of a marketing or advertising campaign in which people are selected to receive them. Tokens may also be provided automatically due to other tokens being held or in case of registration to become eligible to take part in the airdrop.

Income Tax may not apply if cryptoassets are received without doing anything in return (i.e. not related to any service or other conditions) and not as part of a trade or business involving cryptoassets or mining. If airdrops were provided in return for, or in expectation of, a service they are subject to Income Tax either as miscellaneous income or receipts of an existing trade.

The disposal of a cryptoasset received through an airdrop may result in a chargeable gain for CGT purposes (see Capital Gains Tax. General provisions), even though it is not subject to Income Tax when it is received. In cases of trade profits Income Tax takes priority over CGT.

Value of transactions

The taxable income has to be computed and expressed in pounds sterling. This is the default rule that applies to UK residents even though they may carry out many transactions, including transactions with cryptoassets (such as bitcoin), without using pounds sterling. Therefore, rules are needed to bridge the gap between the factual circumstances and sterling figures required in the tax return.

If there is no a sterling value in the transaction (for example if bitcoin is exchanged for ripple or foreign currency) an appropriate exchange rate must be established for the conversion to pounds sterling. The rate is established at the time of each cryptoasset transaction and accurate records should be maintained. Reasonable care needs to be taken with the consistency of the valuation methodology used and all the supportive documents kept.

Capital Gains Tax

General provisions

In the vast majority of cases, individuals hold cryptoassets as a personal investment rather than for a trade in cryptoassets. Being digital in their nature cryptoassets are therefore intangible assets that count as a ‘chargeable asset’ for CGT purposes if they’re both capable of being owned and have a value that can be realised.

In case of their disposal holders will be liable to pay CGT on any gains they realise. A ‘disposal’ is a broad concept that includes selling cryptoassets for money, their exchanging for a different type of cryptoassets, using as means of payment for goods or services as well as gifting them to another person, or entity.

To check if there is any amount of CGT due, it is required to identify the gain for each transaction. Generally, a gain is the difference between what was paid for an asset and what it was sold for. For example, if Mr X uses his cryptoassets (e.g. Bitcoins) that he previously bought for £25,000 to settle his private debt of £60,000 the difference between the purchase price and the amount of the debt, i.e. £35 000 will be subject to CGT. The gains are usually taxable at the rate of 10% for basic rate taxpayers and 20% for the rest subject to possible reliefs provided the conditions are met. Carried interest gains and residential property gains are recognized as ‘upper rate gains’ taxable at 18% or 28% tax rates.

If no consideration was paid at acquisition, or it was given away by the owner to a person who is not a spouse or civil partner, the individual must identify its market value at the relevant date.

Any consideration will be reduced by the amount already subject to Income Tax if it has been previously charged on the value of the cryptoassets received.

The following costs are allowed as a deduction from the amount of the consideration (in pound sterling):

- transaction fees paid before the transaction is added to a blockchain

- advertising for a purchaser or a vendor

- professional costs to draw up a contract for the acquisition or disposal of the cryptoassets

- costs of making a valuation or apportionment for the purpose of calculating any gains or losses (see the example: Pooling).

Care should be given to the fact that any costs deducted against profits for Income Tax as well as costs for mining activities (e.g. equipment and electricity) do not constitute allowable costs for CGT purposes. However, it is possible to deduct some of these costs against profits for Income Tax or on a disposal of the mining equipment itself.

Disposal of cryptoassets for less than their allowable costs may result in a loss. Certain ‘allowable losses’ can be used to reduce the overall gain, but they must be reported to HMRC first. The losses for cryptoassets may also occur if they become worthless or of ‘negligible value’. If an individual opts to make a negligible value claim he will be treated as disposing of the cryptoassets and re-acquired at an amount stated in the claim.

Pooling

HMRC believes that in order to simplify CGT calculations cryptoassets that are ‘of a nature to be dealt in without identifying the particular assets disposed of or acquired’ have to be pooled . It means that instead of tracking the gain or loss for each transaction individually each type of cryptoassets can be kept in a ‘pool’. Originally paid consideration (in pound sterling) for a certain type of cryptoassets goes into the pool and creates its own ‘pooled allowable cost’. Disposal of some assets from a particular pool is considered as a ‘part-disposal’. When calculating the gain or loss a corresponding proportion of the pooled allowable costs would be deducted.

The tokens of the airdropped cryptoasset has to go into their own pool unless the recipient already holds tokens of that cryptoasset, in which case the airdropped tokens will go into the existing pool.

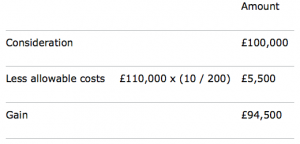

For example, Mr X bought 100 Bitcoins for £10,000. Several months later he also bought 100 Bitcoins for £100,000. For the purposes of CGT calculations Mr X is treated as having a single pool of 200 Bitcoins and total allowable costs of £110,000. Several years later when Mr X sells 10 Bitcoins for £100,000 he will be allowed to deduct a proportion of the pooled allowable costs.

As a result, Mr X will have a gain of £94,500 that is subject to CGT. After the disposal, he will be treated as having a single pool of 190 Bitcoins and total allowable costs of £104,500. If he then sold all 190 of his remaining cryptoassets he would be able to deduct all £104,500 of allowable costs when working out his gain.

As a result, Mr X will have a gain of £94,500 that is subject to CGT. After the disposal, he will be treated as having a single pool of 190 Bitcoins and total allowable costs of £104,500. If he then sold all 190 of his remaining cryptoassets he would be able to deduct all £104,500 of allowable costs when working out his gain.

Care should be given to the fact that there are special pooling rules if an individual acquires tokens within 30 days of selling. These rules state that the new cryptoassets and their costs have to be kept separate from the main pool. It means the gain or loss should be calculated using the costs of the new tokens only.

Blockchain forks

Some cryptoassets operate by consensus amongst that cryptoasset’s community. When a significant minority of the community want to do something different, they may create a ‘fork’ in the blockchain.

There are two types of forks:

(1) a soft fork that updates the protocol and is intended to be adopted by all. In case of a soft fork no new cryptoassets, or blockchain, are expected to be created.

(2) a hard fork is different and can result in new tokens coming into existence. Usually before the fork occurs there is a single blockchain and a second branch (and a new cryptoasset) is created at the point of the hard fork.

The blockchain for the original and the new cryptoassets have a shared history up to the fork. And usually an individual will hold an equal number of tokens on both blockchains after the fork.

The new cryptoassets derive their value from the value of original cryptoassets already held by the individual. Section 43 Taxation of Capital Gains Act 1992 provides for this fact to be recognised in the computation of any gain arising. After the fork the new cryptoassets need to go into their own pool. Any allowable costs for pooling of the original cryptoassets are split between the pool for the original and new cryptoassets.

If an individual holds cryptoassets through an exchange, the new cryptoassets can only be disposed of if the exchange recognises them. In case of non-recognition, the new cryptoasset does not change the position for the blockchain, which will show an individual as owning units of the new cryptoasset.

Costs must be split on a just and reasonable basis under section 52(4) Taxation of Capital Gains Act 1992 whereas HMRC does not prescribe any particular apportionment method.

For further information or to arrange a consultation please contact Yuliya Shved or Dr Frank at Lex e Fiscal.